Why Blockchain is Essential for Purpose-Driven Capital

When you think about traditional investments, whether it's buying a municipal bond through BlackRock or holding onto a treasury bond, the factors that likely come to mind are the term, the return, and, above all, trust. But what happens when you look beneath the surface? If you take a closer look at where your money is going, you might find that it’s funding sectors you didn’t anticipate—like the Department of Defense (DOD), for example. And here's the catch: you’re already funding the DOD through your taxes, so why are you doing it twice?

Now, this isn’t a critique of defense spending, nor is it a debate about how our tax dollars are allocated. Instead, it’s a wake-up call about transparency. You’re supporting a specific industry with no direct return on investment and no clear insight into how those dollars are being spent. For investors who want to make a real difference—whether it’s through affordable housing, community development, or other impact-driven projects—traditional finance often falls short in providing the transparency they need.

That’s where blockchain comes in. And more importantly, that’s where Purpose for Profit leverages blockchain to revolutionize how impact investing can and should work.

Blockchain: Empowering Transparency and Trust

The beauty of blockchain technology lies in its ability to provide transparency in a way that traditional financial institutions simply can’t. At Purpose for Profit, we use blockchain infrastructure that ensures that our investors have complete visibility into how their money is being put to work.

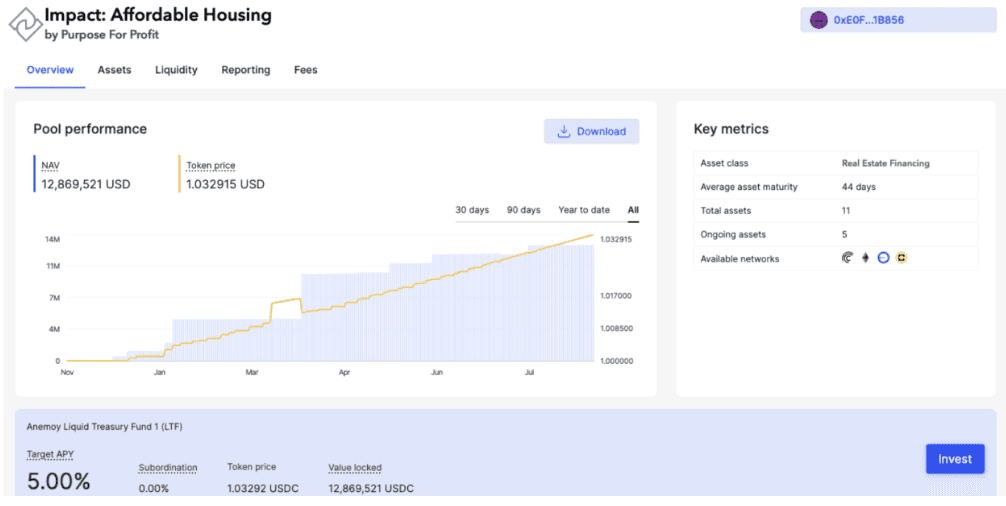

Purpose Impact Fund: Dashboard Overview

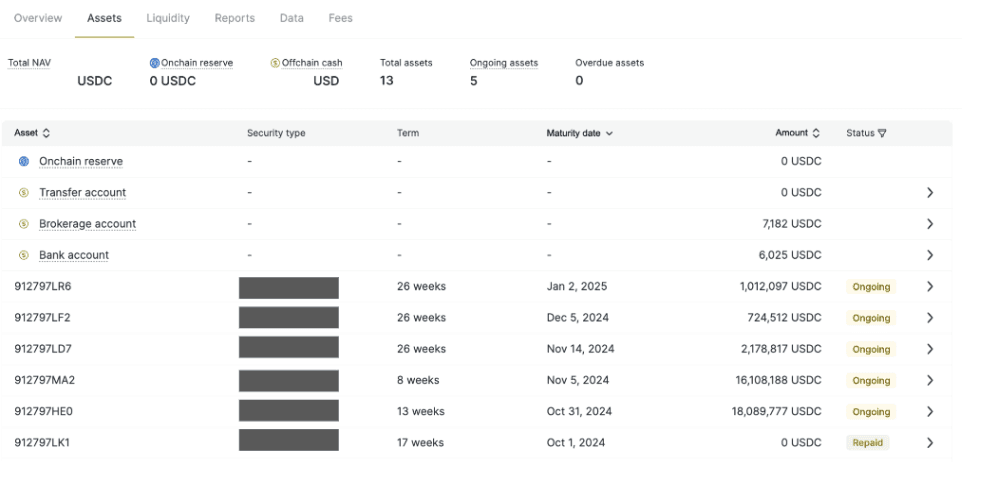

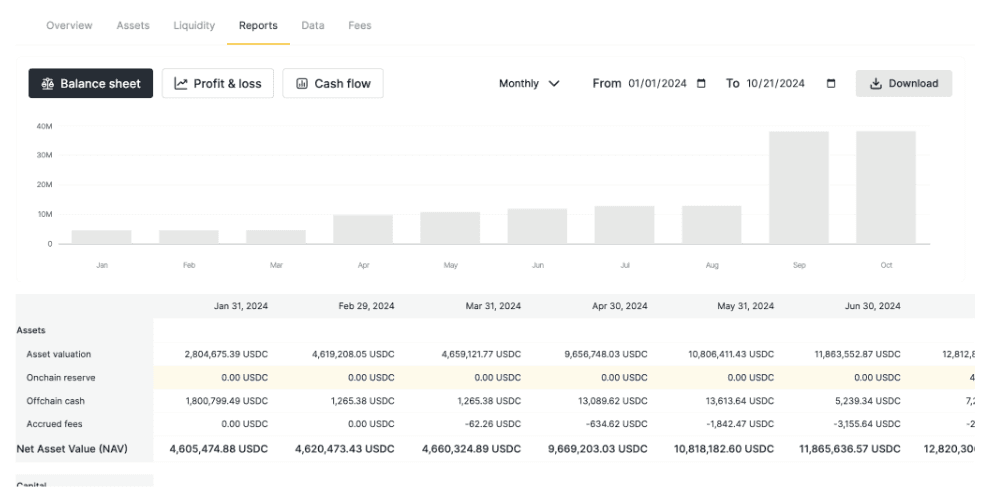

But why does this matter? It matters because whether we like it or not, capital is power and we should each have the ability to decide how we want to flex our financial muscles. When you invest through traditional financial channels, you’re often left in the dark about where your funds are going. You may be able to track broad categories, but the specifics remain elusive. Blockchain enables us to offer real-time insight into the loans under management, payments that have been received or are overdue, and the assets currently in our portfolio. This level of clarity is unprecedented in the traditional investment world.

Purpose Impact Fund: Assets View

We understand that most people aren’t even aware that this kind of transparency is possible—and that’s why it’s so important to showcase what blockchain can do. At Purpose for Profit, we believe that investors deserve to know how their money is working, and blockchain allows us to offer that clarity in a tangible, verifiable way.

Purpose Impact Fund: Report View

NFT-Packaged Loans: How It Works

At Purpose for Profit, we use NFT-packaged loans to make this level of transparency possible. These loans aren’t something that our borrowers or lenders interact with directly—they exist in the background to ensure transparency and trackability. So what exactly does that mean?

Each loan we issue is “wrapped” into an NFT (Non-Fungible Token), which acts as a digital representation of that loan. This NFT is linked to the real-world asset (in our case, affordable housing or other community-focused developments) and tracks everything from the issuance of the loan to its repayment schedule. Because blockchain is immutable—meaning the data can’t be altered once it’s recorded—it provides a level of accountability and visibility that traditional systems simply can’t match.

This NFT contains the most important information required for pricing financing and valuation and can be locked into lending pools as representation of the collateral used for the financing. Any on-chain information attached to these NFTs will be public by default. With real world use cases, investors often require access to extensive information about assets, but the issuer does not normally make this public information.

Utilizing Centrifuge's Private Data Layer to allow issuers and investors to access additional asset data securely and privately. This asset data is hashed and the hash anchored on-chain and added to the NFTs metadata to create a verifiable link to the NFT without making the data publicly available. Technically, the Private Data Layer is a peer-to-peer network of nodes called PODs (“Private Offchain Data Nodes)” connected with each other to securely share information. All actors using this network can decide with whom and how to share the asset level data. Collaborators can be given read access to more detailed off-chain asset data, e.g. for institutional investors in a pool. It is also possible to define write access to specific data fields, which makes use cases possible such as only allowing a third-party valuation agent to price assets.

Why Should Investors Care?

So, does this matter to investors? Absolutely.

In today’s investment landscape, more and more people are looking for ways to align their financial decisions with their values. But the problem is, most investors are conditioned to work within the confines of the systems they know. If you’ve never been offered a way to track your investments with the level of precision that blockchain provides, how could you know it’s possible? That’s the fundamental shift we’re bringing to the table.

By utilizing NFT-packaged loans and blockchain-based fund management, we give investors an unprecedented level of control and transparency over their money. You don’t just have to trust us blindly—you can verify exactly where your funds are going, how they’re performing, and what impact they’re making.

For anyone who’s tired of opaque investment processes and wants to ensure their money is being used to drive meaningful change, blockchain provides the solution.

Conclusion: The Future of Transparent Impact Investing

At Purpose for Profit, we’re not just offering investment opportunities—we’re creating a new paradigm where transparency, trust, and impact go hand in hand. Blockchain isn’t just a buzzword for us; it’s the foundation of a system that empowers our investors to make informed, values-driven decisions.

By leveraging NFT-packaged loans and cutting-edge blockchain infrastructure, we can provide clarity, accountability, and measurable impact—qualities that traditional investment models simply can’t offer.

If you’re looking for a way to maximize returns while driving real-world social impact, Purpose for Profit is leading the way, and blockchain is the key to making it happen.

By Liz Kukka, CEO of Purpose for Profit