Stay Informed with Our Latest News

The Government’s Retreat from Affordable Housing: Why Private Investment Is Stepping In

The United States is grappling with an escalating affordable housing crisis. As federal support wanes, private investors are increasingly stepping in to fill the void. This shift raises questions about the implications for housing affordability and the role of private capital in addressing social challenges.

The Decline of Federal Support for Affordable Housing

Historically, the federal government has played a pivotal role in supporting affordable housing through programs administered by the Department of Housing and Urban Development (HUD). However, recent years have seen a significant reduction in this support. For instance, the Trump administration stalled at least $60 million in funding intended for affordable housing developments nationwide, placing hundreds of projects in jeopardy. Additionally, plans to slash HUD's workforce by 50% and close field offices threaten aid for millions of families.

These cuts come at a time when the demand for affordable housing is at an all-time high. In January 2024, approximately 770,000 people across the country were unable to afford housing and were forced to live in shelters, cars, or on the streets. The reduction in federal support exacerbates this crisis, leaving vulnerable populations with limited options.

The Rise of Private Investment in Affordable Housing

As public funding diminishes, private investors are increasingly stepping in to address the affordable housing shortage. Private equity firms now own nearly 23% of all apartment units in the Tampa Bay area, totaling 56,683 units. Similarly, over 35% of apartments in the Raleigh-Cary metro area are owned by private equity firms—the highest percentage in the U.S.

These investments are not purely altruistic; they offer investors steady returns while addressing a critical social need. In 2024, private investment in affordable housing reached $28.9 billion, a 7.6% increase from the previous year. This influx of private capital is reshaping the affordable housing landscape, bringing both opportunities and challenges.

Implications of Private Equity Ownership

While private investment brings much-needed resources to the affordable housing sector, it also raises concerns about rent increases and tenant displacement. In Tampa Bay, for example, 61% of local renters spend 30% or more of their income on rent and utilities, up from about half in 2019. In Richmond, Virginia, over 25% of renters spent more than half their income on housing in 2023.

However, proponents contend that private investment can lead to higher housing standards and increased availability. Institutional investors claim that their involvement raises housing standards and stabilizes the rental market. They argue that private capital is essential to address the housing shortage, especially in the absence of sufficient public funding.

Balancing Profit and Purpose

The growing involvement of private investors in affordable housing necessitates a delicate balance between profitability and social responsibility. While private capital can accelerate housing development and improve infrastructure, it is crucial to ensure that these investments do not exacerbate housing insecurity.

Policymakers and stakeholders must implement safeguards to protect tenants, such as rent control measures, tenant rights legislation, and incentives for developers to maintain affordability. Collaboration between public and private sectors can foster innovative solutions that address both the housing crisis and investors' interests.

Conclusion

The retreat of government funding in affordable housing has created a significant gap that private investment is beginning to fill. While this shift presents challenges, it also offers opportunities for innovative solutions that balance profitability with social impact. As the housing crisis continues, the collaboration between public and private sectors will be crucial in developing sustainable and inclusive housing solutions.

California’s $300 Billion Housing Crisis: A Challenge for Investors

California’s housing crisis is a pressing $311 billion challenge, fueled by a staggering 3.85 million-unit shortage. As of 2024, median home prices have reached $868,150, with over 181,000 people sleeping without shelter each night, a situation that has worsened over the years (California's housing crisis has gotten worse, not better over the last 30 years). This shortage threatens not only California’s future but its economic stability, draining billions from its GDP annually. High housing costs continue to drive talent away from businesses, creating a unique opportunity for private investment to solve this crisis and deliver profit.

Key Highlights of the Crisis

$311 Billion Housing Deficit

California’s shortage of 3.85 million housing units, part of the U.S.’s 7.1 million-unit gap, has led to soaring home prices of $868,150, with rents rising 39% since 1990, as outlined in recent reports on California's housing crisis.

Government Setbacks

Federal cuts, including a $1 billion HUD program halt and $60 million in stalled grants, have exposed over 50,000 affordable housing units to risk, creating room for private credit solutions, as discussed in AP News.

Economic Impact

The state loses $40 billion annually due to the housing crisis, with 12% of tech hires and 25% of startup workers leaving the state, further pressuring business growth. High housing costs also create a barrier to entry for new businesses, harming California’s economic competitiveness, as reported by Pew Research.

Private Investment

In 2024, private investment in affordable housing reached $24 billion, leveraging a $1.6 trillion credit market with $500 billion available, reducing dependence on government funds, as noted by Cambridge Associates.

The Crisis by the Numbers

California needs 3.85 million new housing units by 2025 to address the housing shortage, representing a $311 billion gap. Median home prices have hit $868,150 statewide, with cities like Los Angeles and San Francisco reaching $1.2 million, far above the national average of $347,000. Rents have increased by 39% since 1990, and homelessness has risen by 47% since 2007, with 181,399 individuals without shelter, comprising 67% of the nation’s homeless population. In 2024, 75,000 people left California due to high living costs, reflecting a larger exodus impacting the state's economy, according to the PPIC.

What’s Driving the Problem?

At the core of California’s housing crisis lies underproduction, a significant issue preventing the state from meeting its housing demand. Despite the need for 180,000 new homes per year to accommodate growth and maintain affordability, California has consistently fallen short, with production averaging around 100,000 homes annually in recent years . This shortfall has led to a housing deficit estimated between 3 to 4 million units as of 2017, exacerbating affordability challenges and contributing to socioeconomic disparities .

A striking example of this imbalance is evident in the Bay Area, where between 2012 and 2017, the region added 400,000 jobs but issued permits for only 60,000 new housing units. This disparity highlights the mismatch between housing supply and demand, intensifying competition for limited housing and driving up costs .

Several factors contribute to this underproduction:

Permitting Delays: A Barrier to Housing Supply

The permitting process poses significant challenges to timely housing development. In San Francisco, obtaining a full building permit for multifamily projects averages 627 days, and for single-family homes, approximately 861 days . These extended timelines discourage developers, limit housing supply, and perpetuate affordability issues. The prolonged approval process is one of the key reasons for the lack of sufficient housing to meet the needs of California's growing population .

Tax Policy: Proposition 13’s Impact on Property Turnover

California’s tax policy has also played a role in the housing crisis. Since the enactment of Proposition 13 in 1978, property tax assessments have been capped, limiting annual increases. While this has benefits for homeowners, it has led to a 20% reduction in property turnover, restricting the availability of land for new development . This "lock-in effect" discourages homeowners from selling, thereby limiting the housing supply and contributing to higher prices. Additionally, homeowners are less likely to sell their properties, further limiting the housing supply, particularly in high-demand areas .

Local Resistance: Opposition to Affordable Housing Projects

Local opposition significantly hampers the development of affordable housing. In Los Angeles, approximately 70% of affordable housing projects face resistance from residents concerned about neighborhood character, increased traffic, or perceived decreases in property values . This NIMBY (Not In My Backyard) sentiment leads to project delays or cancellations, exacerbating the housing shortage .

To address this, state legislation like Senate Bill 35 seeks to streamline approvals for projects in cities not meeting housing goals, aiming to balance local concerns with broader housing needs .

High Construction Costs: Building Homes Is Expensive

Elevated construction costs are a significant barrier to affordable housing. In California, the cost to build a single-family home is approximately $22,000 higher than the national average, primarily due to higher development fees and labor costs . These increased costs make affordable housing projects less financially viable, discouraging developers from pursuing them .

Factors contributing to high construction costs include stringent building codes, labor union requirements, and high-impact fees. While these regulations aim to ensure quality and fairness, they also add to the overall expense of housing projects .Government Retreat from Housing Support

Federal and state support for affordable housing has sharply declined, creating a void that private investment can fill. A $1 billion HUD program was terminated, putting over 50,000 units at risk. Additionally, $60 million in grants were stalled, halting 400 projects. California aimed to build 250,000 units by 2030 but only issued 80,000 permits in 2024, a 68% shortfall, exacerbating the housing crisis (CRISIL Ratings).

Impact on Society and Economy

The effects of California’s housing crisis extend beyond the housing market. Families struggle with high rents, which take up more than half of their income, leaving little for essential expenses like food and healthcare. Homeowners benefit from rising property values, but renters remain stuck, unable to accumulate wealth. Over 181,000 people experience homelessness, costing the state billions in healthcare, shelter, and policing. Businesses, particularly in the tech sector, are also feeling the impact as high housing costs drive talent away, harming job growth and economic performance. The state’s $3.3 trillion GDP suffers as commerce slows, according to McKinsey.

Private Investment Solutions

Private credit is stepping in to fill the gap left by declining government funding. The private credit market, now worth $1.6 trillion, grew by 33% since 2020, with $500 billion ready to deploy. In 2024, private investment directed $120 billion to real estate, with $24 billion going into affordable housing, far outpacing HUD’s $2 billion contribution. The results are impressive:

Quick Wins: Rapid Impact of Private Investment

One of the primary benefits of private investment in affordable housing is the ability to execute projects swiftly and efficiently. For example, H Street DCL, a private developer, invested $15 million to build 300 affordable housing units in Washington, D.C. This project exemplifies how private funding is being leveraged to provide housing quickly in high-demand urban markets. The speed at which private developers can mobilize capital and break ground is one of the key advantages of the private sector, compared to the often slow and bureaucratic processes of government-funded projects. (CBRE)

Long-Term Gains: Sustainable Solutions Through Tax Incentives

Long-term solutions for affordable housing are also being bolstered by private sector growth, with Low-Income Housing Tax Credits (LIHTC) playing a central role in facilitating the development of affordable homes. Since 1986, LIHTC tax credits have successfully funded over 4.5 million homes, helping developers bring affordable housing projects to life across the nation. LIHTC has been one of the most effective tools in encouraging private investment in low-income housing, and its continued success is a testament to the power of tax incentives in driving private sector engagement in the affordable housing market (Housing Credit Coalition).

Private Sector Growth: A Growing Commitment to Affordable Housing

The growth of private investment in affordable housing is not just about funding individual projects but about a sustained and strategic long-term commitment to solving the housing crisis. In fact, private investment in affordable housing has been growing at an annual rate of 12%, outpacing government contributions, which have grown at just 2% per year. This rapid increase in private sector involvement demonstrates a clear shift toward more private credit solutions as the government’s share of funding continues to decline. With private credit markets continuing to expand, the potential for private equity and other forms of private financing to fill the funding gap in affordable housing has never been greater. This shift underscores the importance of the private sector in affordable housing development and positions it as a critical player in shaping the future of housing in the U.S. (PPIC).

PFP Seizes the Opportunity

California’s $300 billion housing crisis, characterized by a 3.85 million-unit shortage and high home prices, represents both a challenge and an opportunity for investors. In 2024, private capital’s $24 billion contribution to affordable housing far exceeded the government’s $2 billion effort. Purpose for Profit (PFP) is stepping in with bridge loans to accelerate housing development where traditional funding falls short. With projections of 500+ units annually, PFP aims to generate $14.25 million in revenue and offers investors 9-11% returns, helping to address the $311 billion housing need within a $1.6 trillion private credit market.

Progressive Decentralization: Building Purpose for Profit with a Co-op Model for the Digital Age

At Purpose for Profit (PFP), our vision extends beyond just providing affordable housing solutions. We’re pioneering a new model of financial collaboration, one rooted in the principles of cooperatives, powered by blockchain, and guided by progressive decentralization. Our goal? To create a globally inclusive financial community that supports affordable housing development, all while empowering PFP members to have an equal voice in decisions and share in the benefits.

Why Cooperatives Are a Powerful Foundation

Traditional cooperatives have proven themselves as effective structures for balancing business growth with community interests. They offer the dual benefits of small business ownership and corporate governance, often focused on creating wealth locally while ensuring members have a voice. By aligning with community priorities, cooperatives build lasting value and foster a sense of shared responsibility among their members.

PFP takes this cooperative model and scales it to a global level, incorporating digital communities and distributed technology. We’re transforming the classic cooperative into a dynamic, decentralized ecosystem that is accessible, inclusive, and resilient. Our goal is to achieve full decentralization within the next five years, following a progressive decentralization model similar to pioneers like ShapeShift. By taking a gradual approach, we ensure that there’s a solid foundation that can adapt while remaining true to our mission.

The Path to Progressive Decentralization

In our journey toward full decentralization, PFP is beginning with a core team of contributors to ensure focus and accountability. Early on, this small group helps avoid the pitfalls of “design by committee”—a problem where too many voices lead to a diluted vision. As our community grows and our operational boundaries adapt, our members will play an increasingly active role in decision-making.

The long-term goal is for the community itself to define and expand PFP’s mission. Members who hold PURPOSE tokens will become voting participants, shaping policies and funding decisions in a way that is both democratic and equitable. Unlike some communities where a small few can hold disproportionate sway, PFP’s model ensures that voting is accessible to everyone, maintaining balance and inclusivity.

Purpose for Profit’s Unique Approach

What makes PFP distinct in the landscape of decentralized organizations?

Impact-Driven, Revenue-Generating Model: We’re a non-profit that funds below-market-rate loans for affordable and mixed-income housing. Our revenue supports both our team’s operations and the lending pool, ensuring financial sustainability without compromising our mission.

Built as a Non-Profit from Day One: Unlike others who pivoted to this model later, PFP has been a non-profit since its inception. We have no shareholders or owners, which makes our transition to a DAO simpler and more aligned with our goals.

Sustainable Token Model: Tokens are distributed only when purchased, with 85% of sales directed to lending and 15% to operations and community rewards. Tokens for community incentives come solely from PFP revenues—early members and the founding team do not receive free tokens. Staking is required to vote, and early stakers get access to specific rewards pools with higher yield. Staking longterm, no matter when you join, also provides benefits.

Endowment for Lasting Impact: At the close of each year, our profits contribute to an endowment that ensures long-term funding for affordable housing projects. This endowment is our promise to support housing efforts in perpetuity.

An Accessible and Inclusive Community

In our progressive decentralization model, we’re building a shared membership framework where participation is accessible to all, including local residents, general contractors, lenders, and newcomers to blockchain alike. For example, members stake tokens to vote rather than spending them, which keeps access affordable and ensures a fair, balanced voice in governance.

PFP isn’t just about decentralizing finance—it’s about creating a space where community members can access opportunities for wealth creation and collective impact. By onboarding local residents and borrowers as participants, we’re breaking down the barriers to blockchain and welcoming new, diverse communities to Web3.

A New Paradigm in Decentralization

As we build toward a fully decentralized model, Purpose for Profit aims to redefine what’s possible with cooperative structures in a digital, global age. We’re creating an inclusive, transparent ecosystem that serves the collective interest and allows every member to contribute to real-world impact. Progressive decentralization is our path forward, and we’re excited to have our community join us on this journey.

Maximize Returns and Drive Social Impact: The Future of Lending for Affordable Housing with Purpose for Profit

When we think about investment, most people gravitate toward familiar avenues like treasury bonds, savings accounts, money market funds or even traditional real estate. These are predictable and widely understood. However, they often don’t make the kind of impact we need in today’s world—particularly when it comes to sectors like affordable housing, which is desperately in need of faster and more flexible funding solutions.

At Purpose for Profit (PFP), we’re offering a new way to drive capital into affordable housing development by leveraging blockchain technology and purpose-driven lending. Our approach is simple: provide lenders with solid returns while making a tangible impact on the communities that need it most. Here’s how we do it.

1. Moving Your Money to Impact Instead of Letting It Sit in Treasury Bonds or Savings Accounts

For many, investing in treasury bonds, money market funds or keeping money in a savings account has long been the default. But with historically low interest rates, these options barely outpace inflation, leaving your money idle instead of working for you. While they may offer a sense of security, they don’t create the meaningful change the world urgently needs. These safe and secure options could also provide you with better returns but they instead take higher margins themselves.

At PFP, we invite you to reconsider where you park your capital. Instead of letting it sit passively in low-yield bonds, money market funds, or savings accounts, why not move it to impact? By reallocating just a portion of your portfolio into impact lending, you can actively support real-world initiatives like affordable housing development. Your money doesn’t just sit still—it works. And in this case, it works to bring much-needed housing solutions to underserved markets faster.

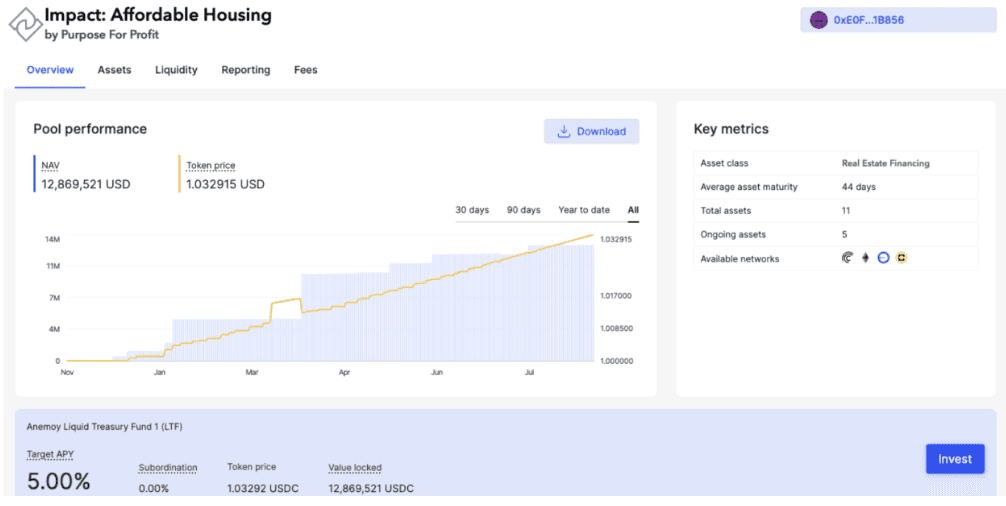

PFP’s innovative infrastructure brings transparency to fund and treasury management - providing real-time insight into loans disbursed, payments received, assets under management and token supply.

Our platform enables investors to contribute to a diversified portfolio of loans that support the development of affordable housing that might otherwise struggle to secure timely funding. Instead of lending directly to individual projects, investors are lending into a broader portfolio that we manage. This approach allows us to make rapid lending decisions—often within weeks—ensuring that projects receive the necessary capital when they need it most. By handling due diligence, credit checks, and lending terms on behalf of investors, we streamline the process and let you focus on earning returns while driving meaningful impact.

2. Earning 5-8% APY with a 6-12 Month Exit: Better Value Than Traditional Real Estate Investments

Real estate has always been a go-to investment for long-term growth, but it comes with drawbacks—namely, the lengthy time horizon. Most traditional real estate investments require a commitment of 3-6 years before you see any significant return, tying up your capital for the long haul.

At PFP, we’re offering a better value proposition: a 9% - 11% Annual Percentage Yield (APY) with a 6 to 12-month exit window with the ability to resubscribe. This means that your money is not only working for impact but also generating returns in a fraction of the time it would take in traditional real estate markets. The shorter exit time frame gives you the flexibility to relend or withdraw your funds, making this a far more dynamic and flexible opportunity.

For those who want to diversify beyond the traditional real estate route, this approach allows you to earn solid returns without the extended lock-up period. Plus, your capital is being used to create real-world, tangible outcomes by accelerating the development of affordable housing projects that would otherwise remain stagnant.

3. Putting Crypto to Work: Supporting Real World Assets (RWA) and Driving Impact

The cryptocurrency market is worth $2.8 trillion, yet much of that capital is sitting idle in speculative assets with little to no connection to real-world impact. The potential to bridge the gap between digital assets and physical infrastructure has never been greater, and that’s where Purpose for Profit comes in.

At PFP, we’re giving lenders the opportunity to put their crypto to work in support of Real World Assets (RWA) like affordable housing. Through our platform, you can use crypto to back loans and support tangible projects that address real societal needs. This isn’t about speculative trading; it’s about using blockchain technology to drive real change.

Our PURPOSE token represents the underlying assets of our projects, providing transparency, security, and the confidence that your funds are being put to work for good. The beauty of blockchain is its ability to make transactions more efficient and transparent, ensuring that every dollar (or token) is accounted for. By supporting RWAs, crypto lenders can finally see their digital assets create something meaningful in the real world—whether that’s new affordable housing units or sustainable community infrastructure.

The Bottom Line: Impact with Purpose and Profit

At Purpose for Profit, our goal is to create a win-win scenario: you earn solid returns while making a significant impact in areas that need it most. Whether you’re moving your money from traditional savings accounts or bonds into impact-driven lending, or putting your crypto to work for real-world assets, the opportunities we offer are designed to accelerate social good while delivering financial rewards.

We believe that purpose-driven capital is the future, and we’re excited to be at the forefront of this movement. By investing in affordable housing through PFP, you’re not just securing your financial future—you’re helping build a world where everyone has a chance to thrive.

Join us in unlocking the potential of purpose-driven capital and let’s make a difference, together.

The Future of Purpose-Driven Capital: Merging Blockchain and Social Impact Initiatives

In a world where social impact is more of a buzzword than an actionable investment strategy, it’s easy to find ourselves stuck in a cycle of charity and donations, rather than solving the deeper issues at play. At Purpose for Profit (PFP), we’ve identified a significant gap in the way people approach impact investments, particularly in areas like affordable housing and other essential services. Too often, the capital available is funneled into more traditional investments like treasury bonds and savings accounts, while the pressing needs of underserved sectors go unnoticed.

Our mission is to change that dynamic and align investor incentives with the needs of communities that have been overlooked—not because they are unbanked or underbanked, but because the financial systems at play don’t prioritize sustainable, impact-driven lending.

Beyond the Unbanked: Investing in Under-Serviced Markets

At Purpose for Profit, we believe in financial inclusion, but we’re not focused on the traditional narrative around the unbanked or underbanked. Instead, we see tremendous opportunity in sectors that are under-serviced because investor incentives are not aligned with the impact they could create. Areas like affordable housing are prime examples. While philanthropists and donors recognize the value of social impact, they rarely view it through the lens of investment. Donations and charity play their part, but what these sectors truly need is capital that works for them long-term.

Investors, too, are missing an opportunity to have their capital work harder while creating measurable impact. Rather than keeping money tied up in low-yield treasury bonds or savings accounts, we’re inviting people to move their money into impact lending—starting with the development of affordable housing.

The Role of Blockchain: Transparency, Efficiency, and Accountability

The integration of blockchain technology is not just a novelty for us—it’s a crucial component that enhances the way we operate and deliver results. We’re not like most crypto companies, whose tokens often lack real-world application or are purely speculative assets. The PURPOSE token is different. It represents the underlying assets of our platform, providing investors with a clear, transparent way to track how their money is being put to work. The token is a reflection of how well Purpose for Profit is performing, giving people more confidence in their investment decisions.

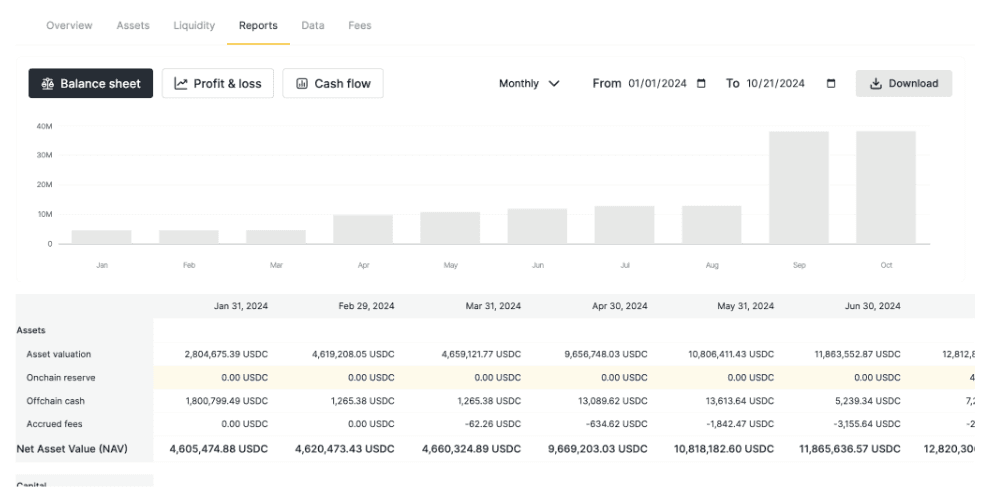

Blockchain offers incredible value in terms of transparency and efficiency. From faster settlement times to secure reporting, it enables us to provide real-time updates on where funds are being deployed and the impact they are creating. This kind of visibility is critical for impact-driven investors, as it offers both accountability and proof of progress—two things often lacking in traditional philanthropic efforts.

Changing the Narrative on Impact Investing

One of the challenges we face in this space is shifting the perception that social impact isn’t a viable investment opportunity. The truth is, social impact initiatives—when properly structured and transparent—can offer both financial returns and real-world benefits. At Purpose for Profit, we’re at the forefront of merging these two elements by creating an ecosystem where people can do good and do well simultaneously.

Our crowdfunding campaign is just the beginning of what we see as a long-term movement to align purpose-driven capital with the needs of underserved sectors. The PURPOSE token will serve as a benchmark for this, giving investors a clear indication that their capital is not only safe but actively making a difference.

Conclusion: A New Era of Purpose-Driven Capital

As we look toward the future, I’m more convinced than ever that blockchain holds the key to fast-tracking the flow of capital into the areas where it’s needed most. This is about more than just financial inclusion—it’s about creating a new standard for how we invest in the future. Purpose-driven capital is the future, and at Purpose for Profit, we’re excited to lead the way

By Liz Kukka, CEO of Purpose for Profit

Why Blockchain is Essential for Purpose-Driven Capital

When you think about traditional investments, whether it's buying a municipal bond through BlackRock or holding onto a treasury bond, the factors that likely come to mind are the term, the return, and, above all, trust. But what happens when you look beneath the surface? If you take a closer look at where your money is going, you might find that it’s funding sectors you didn’t anticipate—like the Department of Defense (DOD), for example. And here's the catch: you’re already funding the DOD through your taxes, so why are you doing it twice?

Now, this isn’t a critique of defense spending, nor is it a debate about how our tax dollars are allocated. Instead, it’s a wake-up call about transparency. You’re supporting a specific industry with no direct return on investment and no clear insight into how those dollars are being spent. For investors who want to make a real difference—whether it’s through affordable housing, community development, or other impact-driven projects—traditional finance often falls short in providing the transparency they need.

That’s where blockchain comes in. And more importantly, that’s where Purpose for Profit leverages blockchain to revolutionize how impact investing can and should work.

Blockchain: Empowering Transparency and Trust

The beauty of blockchain technology lies in its ability to provide transparency in a way that traditional financial institutions simply can’t. At Purpose for Profit, we use blockchain infrastructure that ensures that our investors have complete visibility into how their money is being put to work.

Purpose Impact Fund: Dashboard Overview

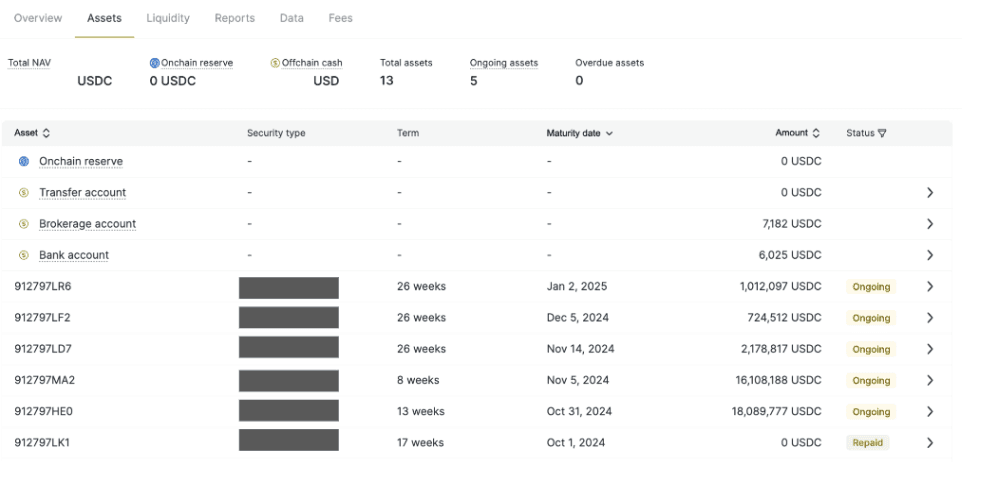

But why does this matter? It matters because whether we like it or not, capital is power and we should each have the ability to decide how we want to flex our financial muscles. When you invest through traditional financial channels, you’re often left in the dark about where your funds are going. You may be able to track broad categories, but the specifics remain elusive. Blockchain enables us to offer real-time insight into the loans under management, payments that have been received or are overdue, and the assets currently in our portfolio. This level of clarity is unprecedented in the traditional investment world.

Purpose Impact Fund: Assets View

We understand that most people aren’t even aware that this kind of transparency is possible—and that’s why it’s so important to showcase what blockchain can do. At Purpose for Profit, we believe that investors deserve to know how their money is working, and blockchain allows us to offer that clarity in a tangible, verifiable way.

Purpose Impact Fund: Report View

NFT-Packaged Loans: How It Works

At Purpose for Profit, we use NFT-packaged loans to make this level of transparency possible. These loans aren’t something that our borrowers or lenders interact with directly—they exist in the background to ensure transparency and trackability. So what exactly does that mean?

Each loan we issue is “wrapped” into an NFT (Non-Fungible Token), which acts as a digital representation of that loan. This NFT is linked to the real-world asset (in our case, affordable housing or other community-focused developments) and tracks everything from the issuance of the loan to its repayment schedule. Because blockchain is immutable—meaning the data can’t be altered once it’s recorded—it provides a level of accountability and visibility that traditional systems simply can’t match.

This NFT contains the most important information required for pricing financing and valuation and can be locked into lending pools as representation of the collateral used for the financing. Any on-chain information attached to these NFTs will be public by default. With real world use cases, investors often require access to extensive information about assets, but the issuer does not normally make this public information.

Utilizing Centrifuge's Private Data Layer to allow issuers and investors to access additional asset data securely and privately. This asset data is hashed and the hash anchored on-chain and added to the NFTs metadata to create a verifiable link to the NFT without making the data publicly available. Technically, the Private Data Layer is a peer-to-peer network of nodes called PODs (“Private Offchain Data Nodes)” connected with each other to securely share information. All actors using this network can decide with whom and how to share the asset level data. Collaborators can be given read access to more detailed off-chain asset data, e.g. for institutional investors in a pool. It is also possible to define write access to specific data fields, which makes use cases possible such as only allowing a third-party valuation agent to price assets.

Why Should Investors Care?

So, does this matter to investors? Absolutely.

In today’s investment landscape, more and more people are looking for ways to align their financial decisions with their values. But the problem is, most investors are conditioned to work within the confines of the systems they know. If you’ve never been offered a way to track your investments with the level of precision that blockchain provides, how could you know it’s possible? That’s the fundamental shift we’re bringing to the table.

By utilizing NFT-packaged loans and blockchain-based fund management, we give investors an unprecedented level of control and transparency over their money. You don’t just have to trust us blindly—you can verify exactly where your funds are going, how they’re performing, and what impact they’re making.

For anyone who’s tired of opaque investment processes and wants to ensure their money is being used to drive meaningful change, blockchain provides the solution.

Conclusion: The Future of Transparent Impact Investing

At Purpose for Profit, we’re not just offering investment opportunities—we’re creating a new paradigm where transparency, trust, and impact go hand in hand. Blockchain isn’t just a buzzword for us; it’s the foundation of a system that empowers our investors to make informed, values-driven decisions.

By leveraging NFT-packaged loans and cutting-edge blockchain infrastructure, we can provide clarity, accountability, and measurable impact—qualities that traditional investment models simply can’t offer.

If you’re looking for a way to maximize returns while driving real-world social impact, Purpose for Profit is leading the way, and blockchain is the key to making it happen.

Subscribe to our Newsletter

Stay updated with the latest news and insights delivered to your inbox every month.